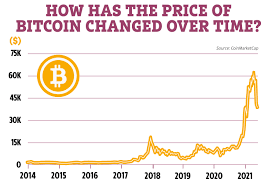

For a better understanding of how Bitcoin has grown and fallen in price, it’s helpful to understand how this currency has evolved over the past 12 years. Its price has risen by as much as 200% in a year, compounding at a rate of between 100 and 200 percent per year. Despite the volatility, early buyers have often seen fantastic returns. While past performance is no guarantee of future results, it is important to know how the cryptocurrency has grown.

The price of Bitcoin has changed drastically since its introduction in 2009. The first large price increase was in 2010, when the value of a single bitcoin jumped from a fraction of a penny to $0.08. The price of this crypto currency has had several rallies and crashes since then. Many compare the cryptocurrency’s rapid rise and fall to the craze for Beanie Babies during the 90’s or Dutch Tulipmania in the 17th century.

The price of Bitcoin has been subject to multiple bubbles in its short existence. However, over the years, the factors that determine the price have changed as the asset has become more popular and more widely accepted. For example, the first time it achieved parity with the U.S. dollar was in February 2011, when BTC reached a high of $52,000. This led to a rapid surge to a price of $30 on the Mt. Gox exchange, more than 100 times the starting price of $0.30.

The Bitcoin price is determined by supply and demand. Demand increases as the number of users increases, and demand decreases when it falls. This means that Bitcoin is immune to fluctuations in demand. While most goods react to an increase in demand by increasing production, Bitcoin does not, due to its difficulty in making adjustments. Therefore, there’s a need to understand how Bitcoin works in order to understand its price history. Before you start investing in this crypto, it’s important to understand how the market works and how this cryptocurrency will affect it in the future.

There are two types of price cycles: bull markets and bear markets. The first is a bubble, while the other is a gradual rise and fall. The bear market began in October 2010 and ended in May 2017, although Bitcoin prices still remain volatile. This is the reason why the price of Bitcoin is dependent on global economics and a global economy. While some fluctuations are inevitable, others are inevitable. As the cryptocurrency industry continues to grow and develop, it is important to understand how it works and why it can affect price movements.

While many cryptocurrencies have a long-term trend, Bitcoin has a volatile trading history. The first major price increase occurred in 2010, when the value of a single bitcoin increased from a fraction of a penny to $08. The second bull run began in April 2013 and continued to the end of that year. In December, it climbed to $380 in two days, but then crashed again. It is difficult to predict the price of Bitcoin and its future prices.

The price of Bitcoin is determined by supply and demand. If demand increases, it will increase in price. Conversely, if the supply decreases, the price will fall. This is a good sign, because it means that the market is stable. A rising bitcoin price will not be unstable. A falling one will not cause a crash. If demand is low, it will be cheaper to produce. But if demand is high, the price will continue to fall.

Considering the history of cryptocurrencies, Bitcoin has been the most volatile of all. In 2011, it rose from a fraction of a penny to almost $830. It has been on the rise since July, but the price of a single bitcoin can fluctuate as much as 30% over a period of time. While the price of a single coin can vary significantly, a high price can make a market look less trustworthy.https://www.youtube.com/embed/a382iupHKP0